Once upon a time, smart people thought the world was flat. As globalization took off, economists pointed to spreading market forces that allowed consumers to buy similar things for the same prices around the world. Others invoked the expansion of liberalism and democracy after the Cold War. For a while, it seemed as if the West’s political and economic ways really had won out.

But the euphoric days of flat talk now seem like a bygone era, replaced by gloom and anxiety. The economic shock of 2008, the United States’ political paralysis, Europe’s financial quagmires, the dashed dreams of the Arab Spring, and the specter of competition from illiberal capitalist countries such as China have doused enthusiasm about the West’s destiny. Once seen as a model for “the rest,” the West is now in question. Even the erstwhile booster Francis Fukuyama has seen the dark, warning in his recent two-volume history of political order that the future may not lie with the places that brought the world liberalism and democracy in the past. Recent bestsellers, such as Daron Acemoglu and James Robinson’s Why Nations Fail and Thomas Piketty’s Capital in the Twenty-first Century, capture the pessimistic Zeitgeist. So does a map produced in 2012 by the McKinsey Global Institute, which plots the movement of the world’s economic center of gravity out of China in the year 1, barely reaching Greenland by 1950 (the closest it ever got to New York), and now veering back to where it began.

It was only a matter of time before this Sturm und Drang affected the genteel world of historians. Since the future seems up for grabs, so is the past. Chances are, if a historian’s narrative of the European miracle and the rise of capitalism is upbeat, the prognosis for the West will be good, whereas if the tale is not so triumphal, the forecast will be more ominous. A recent spate of books about the history of global capitalism gives readers the spectrum. The Cambridge History of Capitalism, a two-volume anthology edited by two distinguished economic historians, Larry Neal and Jeffrey Williamson, presents readers with a window into the deep origins of capitalism. Joel Mokyr’s The Enlightened Economy explains how capitalism broke free in a remote corner of western Europe. And in Empire of Cotton, Sven Beckert, a leading global historian, offers a darker story of capitalism, born of worldwide empire and violence.

WESTWARD HO!

The conventional narrative of the making of the world economy is internalist—that is, that it sprang up organically from within the West. The story goes like this: after the Neolithic Revolution, the global shift from hunting and gathering to agriculture that occurred around 10,000 BC, the various corners of the globe settled into roughly similar standards of living. From China to Mexico, the average person was more or less equal in height (five feet to five feet six inches) and life expectancy (30 to 35 years). Societies differed in their engineering feats, forms of rule, and belief systems. But on the economic front, they boasted common achievements: advanced metallurgy, big walls, and huge pyramids.

Some say that groups of Europeans began to be rewarded for the improved productivity that stemmed from their individualistic habits. Others argue that Europeans stumbled on the right balance of good governance and benevolent self-interest.If there were tragedies, they entailed plagues and blights more than man-made catastrophes. This is not to say that the Mongol conquest of Baghdad in 1258 was polite; of the city’s one million people, more than 200,000 were killed, and the Tigris is said to have run red with blood. But horrific episodes such as this did not determine social well-being, measured as income per person over the long run. That figure remained remarkably constant until about 1500. In this sense, the world was flat. About this portrait, there is consensus.

Where there is debate is over what came next. Some say that groups of Europeans, especially northern Protestants, began to be rewarded for the improved productivity that stemmed from their individualistic habits. Others argue that Europeans stumbled on the right balance of good governance and benevolent self-interest. Either way, late-medieval Europeans found the formula for success, banked on it, and turned it into what, by the nineteenth century, would be known as capitalism.

CAPITALISM RISING

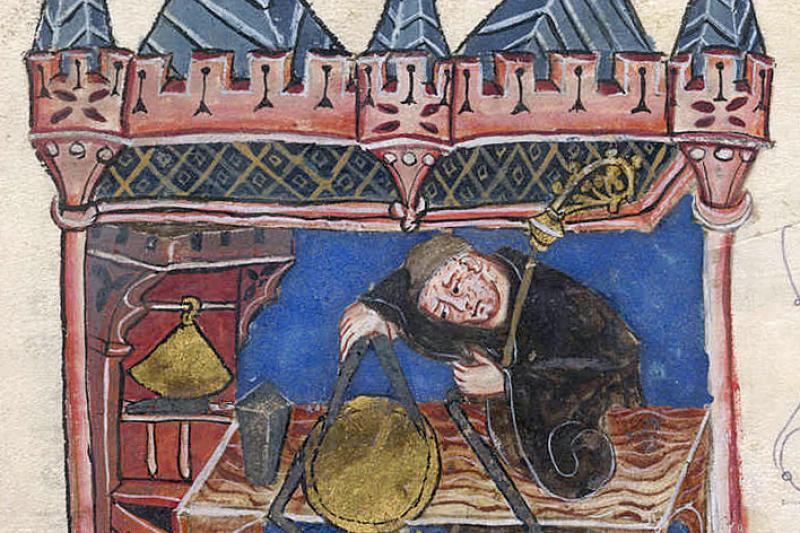

The internalist story remains the most familiar way of explaining the breakout from the long post-Neolithic durée. The Cambridge History of Capitalism goes so far as to argue that elements of capitalism have existed since prehistoric times and were scattered all over the planet; the traits of the individual optimizer were sown into our DNA. Clay tablets recording legal transactions with numbers offer proof of some Mesopotamian capitalist plying his wares. Relics of trading centers in Central Asia trace the primitive optimizer to the steppes. True, for millennia, capitalists were uncoordinated, fragile, and vulnerable. But the origins of capitalism go as far back as archeologists have found remnants of organized market activity. As Neal explains in his introduction, “The current world economy has been a long time in the making.”

Then came a second leap forward with the Industrial Revolution and the spread of the printed word, which, Neal writes, dissolved the “obstacles to imitation.” European societies began to emulate one another. From pockets of accumulation and ingenuity emerged coordinated and, eventually, integrated processes. Coal, timber, draperies, and flatware filled European trade routes.

The globalization of European capitalism has been an uneven and bitter process. Only a few in the periphery, such as Japan, got the mimicry right.Afterward, according to this story, capitalism went global, as European actors and institutions fanned out to join forces with the huddled capitalists in Asia, Africa, and Latin America from the seventeenth to the nineteenth century. But here’s the rub: beyond Europe, capitalism had weaker domestic roots, and so it yielded more conflict and tension in the periphery than in the heartland. Local societies resisted change and resented being viewed as backward, condemned as hewers of wood and drawers of water. The globalization of European capitalism has been an uneven and bitter process. Only a few in the periphery, such as Japan, got the mimicry right; these exceptions help confirm the norm that capitalism is best built from the inside out.

FROM SCIENCE TO WEALTH

There are other ways of explaining how capitalism started in Europe and diffused. Mokyr, for instance, has championed the view that capitalism owes its existence to the cognitive, cultural, and intellectual breakthrough that came about as the scientific revolution swept Europe in the seventeenth and eighteenth centuries. More than any other scholar, he has connected the shifting attitudes to and uses of technology to economic change, crediting the rise of capitalism to an alliance of engineers and investors, tinkerers and moneymen. When those people finally joined forces in the middle of the eighteenth century, the obstacles to growth came crumbling down. In The Enlightened Economy, Mokyr goes further: "A successful economy . . . needs not only rules that determine how the economic game is played, it needs rules to change the rules if necessary in a way that is as costless as possible. In other words, it needs meta-institutions that change the institutions, and whose changes will be accepted even by those who stand to lose from these changes. Institutions did not change just because it was efficient for them to do so. They changed because key peoples’ ideas and beliefs that supported them changed. "

This is a lot of entangled change and rules, and it’s not easy to sort out the causality. The key to Mokyr’s internalist argument is the emergence of what he calls “useful knowledge,” which translated science into production. The process was far from simple. The Enlightened Economy charts the often imperceptible steps that rewarded intellectual innovators and aligned them with impresarios, to create circles of “fabricants” and “savants.” “Interaction” is a key word in Mokyr’s vocabulary; it’s what conjugates curiosity and greed, ambition and altruism. The big breakout came with the Enlightenment, which gave birth to rational thought, the modern concept of good government, and scientific insights into what produced more wealth. After that, there was no looking back.

There are a couple of problems with this kind of history. The first is that what passes for capitalist behavior is so broad that it’s no wonder one can find proof of Homo economicus from time immemorial. Charting the rise of capitalism can be like tracking the hedge fund manager from the hominids who marched out of Africa. Some internalist narratives rely so much on the capitalist as the maker of the system that they define the hero of the story in such a way that he is either unrecognizable to historians who see more in human behavior than material self-interest or so generic that he is hard to separate from the crowd.

The lesson of internalist theories has been “Replicate!” Catch up by copying. But the problem has always been that the nature of catching up makes copying impossible.The other problem involves the scale of analysis. “Britain,” “Europe,” and “the West” are notoriously imprecise and anachronistic terms. Why some city-states and not others? Why not Spain but France? Empires seem to drop out of Mokyr’s story. When they do creep in, they play the role of agents nonprovocateurs, promoting greed of the wrong sort: Spain throttled capitalism because it acquired Aztec gold and then got conquistadors hooked on precious metals and not profits, and the United Kingdom acquired an empire in a fit of absent-mindedness—and that empire was merely an extension of the more important domestic market.

As for explaining the fate of the followers, the lesson of internalist theories has been “Replicate!” Catch up by copying. Borrow the script. Free markets; protect private property. But the problem has always been that the nature of catching up makes copying impossible. As the Russian-born economic historian Alexander Gerschenkron noted, “In several very important respects the development of a backward country may, by the very virtue of its backwardness, tend to differ fundamentally from that of an advanced country.” Finally, as a new crop of global historians has been showing, it is not so easy to isolate the United Kingdom, Europe, or the West from the rest. When it comes to privileged internalist variables, such as scientific knowledge or the Enlightenment, a growing chorus of scholars is finding that West-rest interactions set the stage for the workings of impresarios, engineers, and philosophers. So what role did the rest play in the rise of the West?

THE ROLE OF THE REST

The internalist narrative has long been shadowed by an externalist rival, which sees Europe’s leap forward as dependent on relations with places beyond Europe. Externalists summon a different battery of action verbs. Instead of “coordinating” or “interacting,” the system favored “exploiting” and “submitting.” The most recent externalist explanation of capitalism is Beckert’s Empire of Cotton. The book is a triple threat: it insists that the Industrial Revolution would never have happened without external trade, that the rise of industrialism and factory labor would never have transpired without the spread of slave labor, and that cotton was a commodity that made an empire and thus the world economy. In other words, capitalism was born global because it required an empire to buoy it.

In 1858, James Henry Hammond, a South Carolina planter-senator, thundered on the floor of the Senate, “Cotton is king.” But cotton was not always king in the Atlantic world. For long stretches, it was a mere pawn. Where it was king was in India. At the start of Beckert’s epic tale, in the early eighteenth century, India provided coveted muslins and calicoes for European markets. Its cotton was grown by peasants, along with their food crops, with enough supply to sustain an export boom until the nineteenth century. Europe was a growing, but fringe, market.

So how did India and Europe trade places as the center of the cotton industry? The key lies in the nature of the Atlantic trade. Beckert locates the preindustrial origins of that trade in what he calls “war capitalism.” By this, he means the use of state power to wage war on rivals for markets and possessions and to shove native peoples off their land in the Americas and Africa. While Native Americans were dispossessed, Africans were shipped—about 12 million of them—from one side of the Atlantic to the other. Once American land, African labor, and European capital were bonded together on the cotton plantation, a new source of cotton could finally outmuscle the peasant household on the Indian subcontinent. It was not internalist factors, such as local property rights or useful knowledge, that punched through the capitalist transformation; “a wave of expropriation of labor and land characterized this moment, testifying to capitalism’s illiberal origins,” Beckert argues.

But this was not all. Manufacturers in Europe needed to keep out their Indian competitors and create new markets. Various kinds of protectionist policies came to the rescue, Beckert writes, “testifying . . . to the enormous importance of the state to the ‘great divergence’” between industrializers and those that trailed behind. On the eve of the American Revolution, the British Parliament decreed that cotton cloth for sale at home could come only from cloth made in the United Kingdom. Other European governments did the same.

Even protectionism was not enough. Because European domestic markets alone could not sustain expanding factories, an export boom had to be manufactured. Europeans gave clothes to African traders in return for captives, pressured newly independent countries in Latin America to throw open their markets, and eventually introduced cheap, milled textiles to the bottom end of the Indian market. Thus subverted, Indian peasants became estate sharecroppers producing raw cotton for export to British mills. After the American Civil War, King Cotton fell on hard times, because Brazilian, Egyptian, and Indian estates could hire displaced peasants more cheaply than freed slaves. Once the traditional bond between peasants and land had been severed in Africa, Asia, and the Americas, cotton merchants were free to exploit the land as they saw fit. Beckert writes that from 1860 to 1920, 55 million acres of land in those regions were plowed for cotton. According to some estimates, by 1905, 15 million people made a living by growing cotton—about one percent of the world’s population.

Cotton, “the fabric of our lives,” as the jingle goes, remained an empire because it, like the capitalist system it produced, depended on the subjugation of some for the benefit of others.The cotton industry became so competitive that it attracted arrivistes. Japan, for example, replaced its imported textiles from British India and the United States with raw cotton from Korea in the early twentieth century and so became a new commercial empire in its own right. Belgium and Germany tried the same thing in Africa. Thus was born an imperial spasm in the name of free trade. The circle finally closed when India, too, tried to replace imports with domestic production and economic nationalists lobbied to free the colonial economy from British control. In the 1930s, the original textile manufacturers in the United Kingdom saw their business go overseas in response to labor costs and working-class militants. Mill towns hollowed out. By the 1960s, British cotton textile exports had shrunk to a sliver (2.8 percent) of what they once were. The American South saw its staple flee to Bangladesh. Eventually, Beckert writes, cotton mills in Europe and North America were refurbished as “artist studios, industrial-chic condos, or museums.”

A narrative as capacious as this threatens to groan under the weight of heavy concepts. In fact, Beckert dodges and weaves between the big claims and great detail. His portrait of Liverpool, “the epicenter of a globe-spanning empire,” puts readers on the wharves and behind the desks of the credit peddlers. His description of the American Civil War as “an acid test for the entire industrial order” is a brilliant example of how global historians might tackle events—as opposed to focusing on structures, processes, and networks—because he shows how the crisis of the U.S. cotton economy reverberated in Brazil, Egypt, and India. The scale of what Beckert has accomplished is astonishing.

Beckert turns the internalist argument on its head. He shows how the system started with disparate parts connected through horizontal exchanges. He describes how it transformed into integrated, hierarchical, and centralized structures—which laid the foundations for the Industrial Revolution and the beginnings of the great divergence between the West and the rest. Beckert’s cotton empire more than defrocks the internalists’ happy narrative of the West’s self-made capitalist man. The rise of capitalism needed the rest, and getting the rest in line required coercion, violence, and the other instruments of imperialism. Cotton, “the fabric of our lives,” as the jingle goes, remained an empire because it, like the capitalist system it produced, depended on the subjugation of some for the benefit of others.

IMPERIAL DISCONTENTS

Like the heroic capitalist rising and spreading his wings in the internalist narrative, the distinctly unheroic empire in the externalist narrative functions as the machine that made itself. This raises all the same problems of circularity: empire becomes the cause and the effect of capitalism. It also raises problems of how to join inequality and integration, both of which lie at the heart of Beckert’s book. Contrary to the externalist precept, coercion need not be the only binding force when power relations are asymmetric; global domination is not necessarily inherent to capitalism. Maybe it is because the English language lacks the right terms to describe a global order of uneven and asymmetric parts that externalists resort to shortcuts such as “empire” or “hegemony.” Internalists, by contrast, offer a vocabulary that accents choices and strategies, such as “creating opportunities” and “maximizing returns.”

Indeed, it’s the interaction of the local and the global that makes breakouts so difficult—or creates the opportunity to escape.Most historians side with a single narrative, captive to stories of capitalism as either liberating or satanic, springing from below or imposed from above. In order to plumb the past of global capitalism, however, they need a stock of global narratives that get beyond the dichotomies of force or free will, external or internal agents. To explain why some parts of the world struggled, one should not have to choose between externalist theories, which rely on global injustices, and internalist ones, which invoke local constraints.

Indeed, it’s the interaction of the local and the global that makes breakouts so difficult—or creates the opportunity to escape. In between these scales are complex layers of policies and practices that defy either-or explanations. In 1521, the year the Spanish defeated the Aztec empire and laid claim to the wealth of the New World, few would have predicted that England would be an engine of progress two centuries later; even the English would have bet on Spain or the Ottoman Empire, which is why they were so committed to piracy and predation. Likewise, in 1989, as the Berlin Wall fell and Chinese tanks mowed through Tiananmen Square, “Made in China” was a rare sight. Who would have imagined double-digit growth from Maoist capitalism? Historians have trouble explaining success stories in places that were thought to lack the right ingredients. The same goes for the flops. In 1914, Argentina ranked among the wealthiest capitalist societies on the planet. Not only did no one predict its slow meltdown, but millions bet on Argentine success. To find clues to success or failure, then, historians should look not at either the world market or local initiatives but at the forces that combine them.

Alternative narratives may have to come from beyond the heartland of capitalism itself, the home of classical fables of modernization. In the nineteenth century, many liberals outside Europe struggled to find a different path, because copying the West was a hopeless pursuit. Since they could not claim histories of capitalism as their own but still believed in the credos of liberalism, they tried to think beyond the binary choice of coercion or free will. Juan Bautista Alberdi, the father of Argentina’s 1853 constitution and a native of the country’s cotton province of Tucumán, was devoted to free trade and opening up frontier lands for the production of commodities. Like many global liberals, he insisted that governments did not have to resort to coercion to integrate supply chains. Alberdi was a fierce critic of using war as a means to modernize, and he blasted Argentine and Brazilian elites for colluding during the Paraguayan War of 1864–70, the South American echo of the American Civil War. His work represents but one example of capitalist endeavors that were neither carbon-copied nor made out of the barrel of a gun.

The dichotomy between internalists and externalists is harmful because it creates a pressure to rely on just one of their heroic and unheroic duelers to explain capitalist development. In fact, the payoff from global history comes from thinking about capitalism in multiple ways and on multiple scales. Surely, the travails of the rest serve as a reminder that the isms of the West are neither as inevitable nor as durable as their chroniclers or critics believe.

You are reading a free article.

Subscribe to Foreign Affairs to get unlimited access.

- Paywall-free reading of new articles and a century of archives

- Unlock access to iOS/Android apps to save editions for offline reading

- Six issues a year in print, online, and audio editions